Discover the Old National Bank Routing Number Fast

Introduction

You’re about to send money or set up direct deposit, and suddenly you hit a wall. Someone asks for your routing number. If you bank with Old National Bank, you might wonder where to find this mysterious nine-digit code.

Don’t worry. You’re not alone in this confusion. The old national bank routing number is something most people need at some point, yet few understand what it actually does. Think of it as your bank’s fingerprint. It identifies your financial institution in the massive network of American banks.

This article will walk you through everything about Old National Bank’s routing numbers. You’ll learn what they are, why they matter, where to find yours, and how to use them correctly. By the end, you’ll handle routing numbers like a banking pro.

What Is a Routing Number?

A routing number is a nine-digit code that identifies your bank. The American Bankers Association created this system back in 1910. Yes, it’s been around for over a century.

Every bank in the United States has at least one routing number. Large banks often have multiple routing numbers. They might use different codes for different states or types of transactions.

The old national bank routing number works as an address for your bank. When you send or receive money, the routing number tells the payment system where to find your bank. Without it, your money would get lost in the banking network.

These numbers aren’t random. The first four digits identify the Federal Reserve routing symbol. The next four digits represent the bank itself. The final digit is a mathematical check digit that validates the entire number.

Why You Need Your Old National Bank Routing Number

You’ll use your routing number more often than you think. It’s essential for several common banking activities.

Direct deposit is probably the most common use. When you start a new job, your employer needs your routing number to send your paycheck to your account. Without it, you can’t get paid electronically.

Bill payments also require routing numbers. When you set up automatic payments for utilities, loans, or subscriptions, companies need this code to withdraw money from your account.

Wire transfers depend entirely on routing numbers. Whether you’re buying a house, sending money to family, or making a large purchase, wire transfers need both your routing number and account number.

ACH transfers use routing numbers too. These are the electronic transfers you make through apps or online banking. They’re slower than wire transfers but usually free.

Tax refunds from the IRS need your routing number. If you want your refund deposited directly into your account, you must provide this information on your tax return.

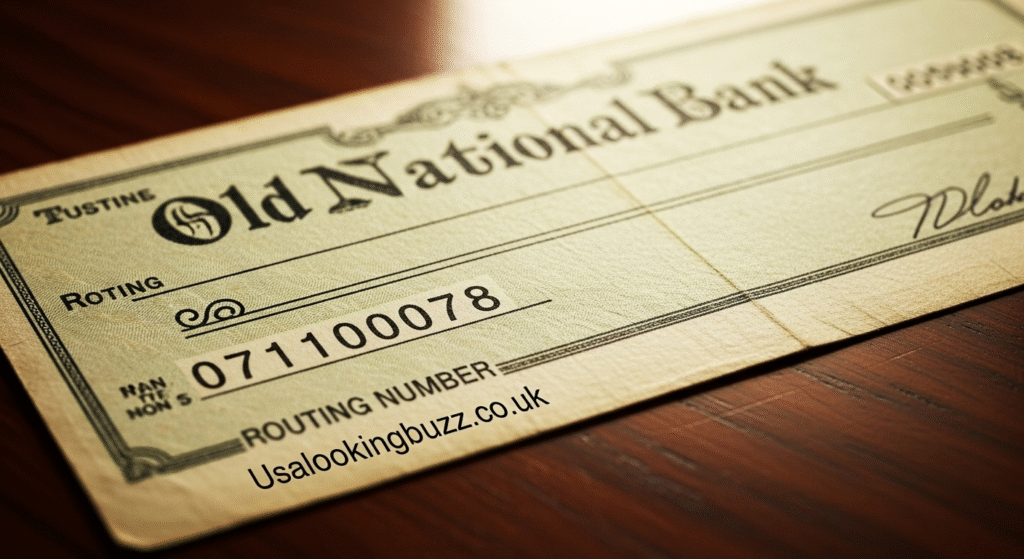

The Main Old National Bank Routing Number

Old National Bank uses 086300012 as its primary routing number. This nine-digit code works for most customers across most states.

This routing number handles the majority of transactions. You can use it for direct deposits, ACH transfers, and most electronic payments. It’s the number you’ll find on your checks and online banking portal.

However, here’s something important to know. Old National Bank has expanded through mergers and acquisitions over the years. If your account came from a bank that Old National purchased, you might still be using a different routing number.

I recommend checking your specific routing number before making important transactions. Using the wrong routing number can delay payments or cause transfers to fail completely.

Finding Your Old National Bank Routing Number

You have several ways to locate your routing number. Each method is simple and takes just minutes.

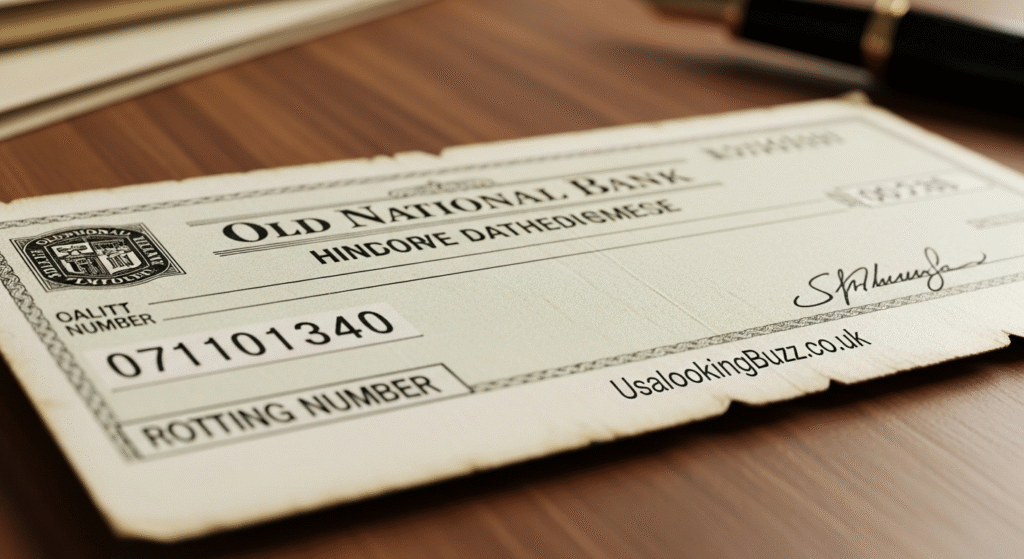

Check Your Checks

The easiest method is looking at your checks. The routing number appears at the bottom left corner. It’s the first set of nine digits.

You’ll see three sets of numbers at the bottom of each check. The first nine digits are your routing number. The middle set is your account number. The final set is the check number.

Some people confuse these numbers. Remember, routing always comes first when reading from left to right.

Log Into Online Banking

Your online banking account displays your routing number clearly. Log in to your Old National Bank account through their website or mobile app.

Navigate to your account details or settings section. Most banks show routing numbers on the main account page. You might see it labeled as “Routing Number,” “ABA Number,” or “RTN.”

This method gives you the correct routing number for your specific account. It’s more reliable than guessing or using a general number you found online.

Call Customer Service

When in doubt, call Old National Bank directly. Their customer service team can verify your routing number in seconds.

The bank’s phone number is available on their website and your monthly statements. Have your account number ready when you call. This helps them locate your information quickly.

Customer service can also confirm if your account uses a special routing number. This matters if your account came from a merged bank.

Check Your Bank Statements

Your monthly statements include your routing number. Look at the top or bottom of the statement. Banks usually print account details in these areas.

Paper statements and electronic statements both show this information. If you’ve gone paperless, log in to view your most recent statement online.

Old National Bank Routing Numbers by State

Old National Bank operates across multiple states. While 086300012 works for most locations, some regions might use different routing numbers.

The bank primarily serves customers in Indiana, Illinois, Kentucky, Michigan, Minnesota, and Wisconsin. Most customers in these states use the main routing number.

After mergers, some branches retained their original routing numbers temporarily. If you opened your account at a bank that Old National later acquired, your routing number might differ from the standard one.

Geographic location can affect your routing number. Banks sometimes assign different codes to different processing centers. Your account’s routing number depends on where you opened it.

Always verify your specific routing number before making financial transactions. Using an incorrect number won’t send money to someone else’s account, but it will cause your transaction to fail or bounce back.

How to Use Your Routing Number Safely

Your routing number isn’t as sensitive as your account number, but you should still protect it. Anyone with your routing and account numbers could potentially withdraw money from your account.

Only provide your routing number to trusted sources. Employers, government agencies, and established companies are safe. Random people or unknown websites requesting this information should raise red flags.

Never share your banking information through email or text messages. Legitimate organizations won’t ask for this data through these channels. Scammers often pose as banks or government agencies to steal financial information.

When setting up direct deposit or automatic payments, enter your routing number carefully. One wrong digit will cause the transaction to fail. Double-check every number before submitting.

Keep records of where you’ve shared your routing number. If you notice unauthorized transactions later, this list helps you identify the source of the problem.

Common Mistakes People Make With Routing Numbers

Even simple tasks can go wrong when dealing with routing numbers. Here are mistakes you should avoid.

Confusing routing numbers with account numbers is extremely common. Remember, routing numbers identify the bank. Account numbers identify your specific account at that bank. You need both for most transactions.

Using an old routing number after moving or switching accounts causes problems. If you recently relocated or transferred your account to a different branch, verify your current routing number.

Transposing digits happens more often than you’d think. The number 086300012 could easily become 086300021 if you’re not careful. Always double-check what you’ve entered.

Assuming all routing numbers are the same for a bank is wrong. Large banks like Chase or Bank of America have dozens of routing numbers. While Old National Bank primarily uses one, you should still confirm yours.

Forgetting to update routing numbers after bank mergers creates confusion. If Old National Bank merges with another institution, your routing number might change. Watch for notifications from your bank about these updates.

Wire Transfers and Old National Bank

Wire transfers work differently than regular ACH transfers. They’re faster, more expensive, and require extra attention to routing numbers.

For domestic wire transfers to your Old National Bank account, the standard routing number typically works. However, some banks use separate routing numbers specifically for wire transfers.

International wire transfers require a SWIFT code instead of a routing number. Old National Bank’s SWIFT code is different from its routing number. If you’re receiving money from overseas, you’ll need to provide both codes.

Wire transfer fees vary by bank. Old National Bank charges fees for both sending and receiving wires. Incoming domestic wires typically cost around $15. Outgoing wires can cost $25 or more.

These transfers process almost immediately. Unlike ACH transfers that take one to three business days, wire transfers usually complete within hours. This speed makes them ideal for time-sensitive payments.

Before sending a large wire transfer, call Old National Bank to confirm the correct routing number. One mistake could send thousands of dollars to the wrong place.

ACH Transfers and Your Routing Number

ACH stands for Automated Clearing House. These electronic transfers move money between banks through a centralized network.

Most people use ACH transfers without realizing it. Direct deposits, automatic bill payments, and peer-to-peer payment apps all rely on ACH processing.

ACH transfers take longer than wire transfers but cost much less. Most banks, including Old National Bank, process ACH transactions for free or for minimal fees.

The old national bank routing number for ACH transactions is the same one you use for other electronic transfers. You don’t need a separate code for ACH payments.

These transfers have daily limits. Banks restrict how much money you can send through ACH to prevent fraud. If you need to transfer a large amount, you might need to split it across multiple days or use a wire transfer instead.

What Happens If You Use the Wrong Routing Number

Mistakes happen. Understanding the consequences helps you fix them quickly.

Transactions will likely fail. The banking system validates routing numbers before processing transfers. An invalid routing number triggers an automatic rejection.

Your money won’t disappear into thin air. If the routing number doesn’t exist or doesn’t match your account number, the payment system returns the funds to the sender. This process takes a few days.

You might face fees. Banks sometimes charge for failed transactions or returned payments. Old National Bank might assess a fee if your direct deposit or automatic payment bounces due to incorrect information.

Delays cause problems. A failed paycheck deposit means you won’t have access to your money when expected. Bounced bill payments could result in late fees from the company you’re trying to pay.

If you realize you’ve entered the wrong routing number, contact both banks immediately. The sending bank might be able to recall the transaction before it processes completely.

Old National Bank Mergers and Routing Numbers

Old National Bank has grown significantly through acquisitions. Understanding this history helps explain why some customers use different routing numbers.

The bank has acquired numerous smaller financial institutions over the years. When these mergers happen, Old National Bank typically allows acquired banks to keep their original routing numbers temporarily.

This transition period can last months or even years. Eventually, Old National Bank consolidates accounts and switches everyone to standard routing numbers. You’ll receive notifications if your routing number changes.

Recent major acquisitions include First Midwest Bank and several community banks. If you were a customer of one of these institutions, your routing number might still reflect the old bank.

Check your current routing number regularly, especially after hearing news about bank mergers. Your monthly statements will show any changes, and Old National Bank will send direct notifications about routing number updates.

Never assume your routing number stays the same forever. Banks update these codes periodically, especially after major corporate changes.

Routing Numbers vs. Account Numbers

People constantly mix up these two numbers. Let’s clarify the difference once and for all.

Your routing number identifies Old National Bank within the banking network. Think of it as the bank’s mailing address. Every customer of Old National Bank in the same region typically shares the same routing number.

Your account number is unique to you. It identifies your specific checking or savings account within Old National Bank. No other customer has your exact account number.

Both numbers appear on your checks. The routing number comes first (nine digits). Your account number comes second (usually 10 to 12 digits).

When someone asks for your banking information, they usually need both numbers. Providing just one won’t work for most transactions.

Routing numbers are somewhat public information. Banks publish them on their websites and in directories. Account numbers are private and should never be shared publicly.

Mobile Banking and Routing Numbers

Modern banking apps make finding your routing number incredibly easy. Old National Bank’s mobile app displays your routing number prominently.

Open the app and navigate to your account details. Tap on your checking or savings account. Look for an option like “Account Information,” “Details,” or a small “i” icon.

The app shows both your routing and account numbers. Some apps even let you copy these numbers directly, reducing typing errors when you need to enter them elsewhere.

Mobile check deposit uses your routing number behind the scenes. When you photograph a check through your banking app, the software reads the routing number to verify which bank issued the check.

You can also set up mobile person-to-person payments through your app. Services like Zelle integrate with Old National Bank’s mobile platform. These features need your routing number to function, though the app handles this automatically.

The mobile app provides 24/7 access to your banking information. You don’t need to wait for business hours or dig through old checks to find your routing number.

International Considerations

If you’re dealing with international transactions, routing numbers work differently.

American routing numbers only function within the United States. Other countries use different systems. Europe uses IBAN codes. Other regions have their own identification methods.

For receiving international wire transfers, you need Old National Bank’s SWIFT code. This is a different type of identifier used for cross-border transactions. Contact the bank directly to get this information.

Sending money overseas requires the recipient’s SWIFT code or equivalent. Your Old National Bank routing number helps move money from your account to the international payment system, but it won’t route money to foreign banks.

Currency conversions add complexity to international transfers. Exchange rates and conversion fees affect how much money actually arrives at the destination.

International transfers take longer and cost more than domestic ones. Plan ahead if you need to send or receive money from another country.

Security and Fraud Prevention

Protecting your routing number is part of good financial hygiene. While it’s less sensitive than your account number, you should still be cautious.

Phishing scams often target banking information. Criminals pose as your bank and request routing numbers, account numbers, and passwords. Old National Bank will never ask for this information through email, text, or unsolicited phone calls.

Check fraud is another concern. Your routing number appears on every check you write. Criminals can use this information, combined with your account number, to create counterfeit checks.

Monitor your accounts regularly. Log into online banking at least weekly to review transactions. Report any suspicious activity to Old National Bank immediately.

Enable alerts through your mobile app. Old National Bank can send text or email notifications when large transactions occur. These alerts help you catch fraud quickly.

Consider using positive pay services if you write many checks for business purposes. This service lets you pre-authorize checks, preventing unauthorized checks from clearing your account.

Future of Routing Numbers

Banking technology evolves constantly. You might wonder if routing numbers will become obsolete.

For now, routing numbers remain essential to the American banking system. The infrastructure supporting these nine-digit codes is deeply embedded in financial networks.

FedNow and other instant payment systems are changing how money moves between banks. These newer systems still use routing numbers but process transactions much faster than traditional ACH transfers.

Cryptocurrency and blockchain technology could eventually replace routing numbers entirely. These systems don’t need central routing codes because they operate on decentralized networks. However, widespread adoption is still years or decades away.

The old national bank routing number will likely remain relevant for the foreseeable future. Major changes to banking infrastructure happen slowly because so many systems depend on existing standards.

As technology advances, you might interact with routing numbers less directly. Apps and digital wallets increasingly handle these details behind the scenes. But the numbers themselves will continue working in the background.

Conclusion

Your Old National Bank routing number is a simple tool that enables important financial transactions. Whether you’re setting up direct deposit, paying bills automatically, or transferring money, this nine-digit code connects your account to the broader banking network.

The main routing number for Old National Bank is 086300012, but always verify your specific number through your checks, online banking, or customer service. Taking two minutes to confirm this information can save you from delayed payments and unnecessary fees.

Now that you understand routing numbers thoroughly, you can handle banking tasks with confidence. Keep your routing number accessible but protected. Update it when necessary. And remember, when in doubt, Old National Bank’s customer service team is always ready to help.

Have you ever had a problem with a routing number? Share your experience or questions in the comments below.

FAQs

What is Old National Bank’s routing number? The primary routing number for Old National Bank is 086300012. This nine-digit code works for most customers across all states where Old National Bank operates. However, if your account came from a bank that Old National acquired, you might use a different routing number. Always verify your specific routing number through your checks, online banking, or by calling customer service.

Where can I find my Old National Bank routing number? You can find your routing number in several places. Check the bottom left of your personal checks where it appears as the first nine-digit number. You can also log into online banking or the mobile app to view your routing number. Additionally, it appears on your bank statements. If you cannot locate it through these methods, call Old National Bank customer service for assistance.

Is the routing number the same for all Old National Bank customers? Most Old National Bank customers use the same routing number, but not all. The bank has acquired other financial institutions over the years, and some acquired accounts temporarily retain their original routing numbers. Your routing number might also differ based on when and where you opened your account. Always confirm your specific routing number before making important transactions.

Can I use my routing number for international transfers? No, routing numbers only work for domestic transactions within the United States. For international wire transfers, you need Old National Bank’s SWIFT code instead. Contact the bank directly to obtain the correct SWIFT code for receiving international transfers. International transactions also require additional information beyond just routing and account numbers.

What happens if I enter the wrong routing number? If you enter an incorrect routing number, your transaction will most likely fail. The banking system validates routing numbers before processing transfers. An invalid number triggers an automatic rejection, and your money returns to the sender after a few days. You might face fees for failed transactions, and the delay could cause problems with time-sensitive payments like payroll deposits or bill payments.

Do wire transfers and ACH transfers use the same routing number? For Old National Bank, wire transfers and ACH transfers typically use the same routing number. However, some banks use different routing numbers for these transaction types. If you’re sending or receiving a wire transfer, especially a large amount, call Old National Bank to confirm the correct routing number. This extra step prevents costly mistakes.

How do I know if my routing number changed after a bank merger? Old National Bank will notify you directly if your routing number changes due to a merger or acquisition. Check your monthly statements for notices about routing number updates. You can also verify your current routing number through online banking or by calling customer service. If you were a customer of a bank that Old National acquired, pay special attention to communications about account transitions.

Is it safe to give out my routing number? Your routing number is less sensitive than your account number, but you should still be cautious about sharing it. Only provide your routing number to trusted sources like employers, government agencies, and established companies. Never share banking information through email or text messages, as these could be phishing attempts. Legitimate organizations have secure methods for collecting financial information.

Can I have multiple routing numbers if I have multiple accounts? You typically use the same routing number for all your accounts at Old National Bank, even if you have multiple checking or savings accounts. The routing number identifies the bank itself, not your individual accounts. Your account numbers differentiate between your various accounts. However, if you have accounts from different branches or acquired banks, you might have different routing numbers for different accounts.

What’s the difference between a routing number and an account number? A routing number identifies your bank within the banking network. It’s like the bank’s address. All Old National Bank customers in the same region typically share the same routing number. An account number is unique to you and identifies your specific account within the bank. Both numbers appear on your checks. The routing number comes first and has nine digits, while account numbers usually have 10 to 12 digits.

Also Read Usalookingbuzz.co.uk